Difference Gambling And Investment

Posted By admin On 29/03/22If you are like many people eager to multiply their money, you have probably at some point been confused about the concepts of gambling and investing your money. I have been there too.

Many investors feel that stock market investing is just like gambling. However, there are major differences between gambling & investing. Read this article to know more! Another key difference between the two activities has to do with the concept of time. Gambling is a time-bound event, while an investment in a company can last several years. With gambling, once.

Some years ago when I was living in the hostel at University of Uyo, I can remember vividly how some of my roommates where so into “akpos”, a nickname for football betting. It was the reigning thing of the day among students, and it still is.

I never took interest in “akpos” but I couldn’t help but overhear them discussing their wins and loses – mostly loses. That is how I became familiar with a few betting jargons like odds, draws, play to win, etc.

In the minds of some of these students, I believe they were genuinely seeking ways to multiply their limited allowance so they could survive the hostel life. So I wouldn’t blame them.

However, there were a some of them that were into “akpos”, not because they needed the money, but because they were addicted. How else would you describe someone that gambles away their school fees? Still there were others who played “akpos” because they were convinced it is a legitimate way to invest and grow their money.

Today, so many youths are into football betting that there is a betting shop on almost every street in this country. If betting were the same thing as investment, one would almost think that the prevalence of these shops would translate into immense wealth for all of their customers. But this is not the case because betting is gambling, not investment.

In fact, chronic betters are mostly in debt. Some do engage in social vices so they can get the money they need to sustain their lifestyle. So where is the wealth? 🤷

This brings us to the question – what are the similarities and differences between gambling and investing? Which of them should a financially intelligent person engage in and why?

To properly address this topic, let’s define the terms.

What is Gambling?

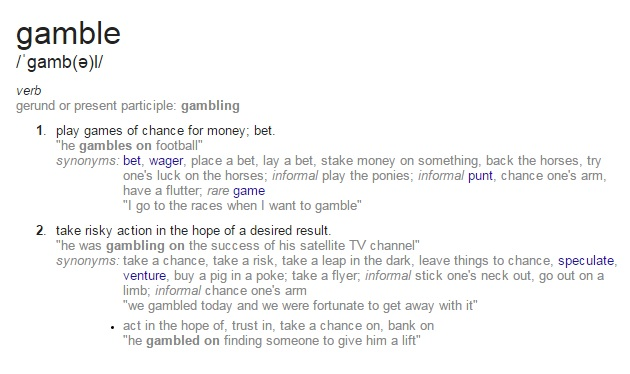

According to the English dictionary, gambling is an activity characterised by a balance in winning and losing that is governed by a mixture of skill and chance, usually with money wagered on the outcome.

Also known as betting or wagering, it means risking money on an event that has an uncertain outcome and heavily involves chance, mainly as a form of entertainment.

Take note of the words skill and chance. This is to mean that gambling involves both a percentage of skill and chance. Synonyms for chance include opportunity, possibility, probability, fate, random occurrence and luck.

Given that anyone with zero football analysing skills can correctly predict a winning score, let’s put the ratio of chance to skill at 80:20 percent respectively. Gambling is betting on the possible outcome of an event.

Besides relying heavily on chance, virtually all forms of gambling is meant to be a loss for the player who is placed at a drawback from the start because the betting company always has an edge over the gambler. The possibility of winning is therefore small and random.

Popular examples of gambling scenarios include casinos, card games, poker, blackjack, lottery and sports gambling like football bet, horse racing, roulette and craps.

What is Investing?

According to Investopedia, Investing is the act of allocating funds or committing capital to an asset, like stocks, with the expectation of generating an income or profit. Investing is widely regarded as the engine that drives capitalism. It tends to put money in the hands of those with the most promising and productive uses for it, and drives the economy gradually upward.

When it comes to investing, the expectation of a return in the form of income or price appreciation is the core premise of investing. Risk and return go hand-in-hand in investing; low risk generally means low expected returns, while higher returns are usually accompanied by higher risk.

Unlike in gambling, when you invest in something, you own it. You can own shares of a company or other securities by investing your money. When the company makes profit and pays-out dividends, you also benefit from it. Also, if the price of stocks you own rise, you can sell them at a gain.

This is not to say that the risk of losing money in a bad investment completely eliminated. No!

The fact is, while some investments do go wonky, it is typical for investors to evaluate their investment processes and strategies, consider various risk factors, and watch the math work. This careful evaluation minimizes their risk of losing out.

There are various examples of investments but they mainly fall under one of these 5 classes:

- Small Business

- Paper Assets

- Real Estate

Difference Between Investment And Gambling With Comparison Chart

- Intellectual Property, and

- Commodities.

Investing involves the possibility of profits and losses based on performance of the asset.

“An investment operation is one which upon thorough analysis promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.” —Benjamin Graham

How are they similar?

1. Both involve the risk of capital with the hopes for future profit.

2. Both gambling and investing involves people making rational judgements and making a choice to risk their money.

3. In both gambling and investing, a key principle is to minimize risk while maximizing reward.

How are they different?

1. The Concept of Time.

Gambling is typically a short-lived activity, while equities investing can last several years to a lifetime. Once the game you are gambling on is over, your opportunity to profit has come and gone. You either win or lose.

In contrast, people make money from the stock market by simply holding on to the stock. Companies are bound to pay you dividends as a reward for risking your money regardless of what happens to your capital. There is the alluring prospect of capital growth and compounding returns over time.

2. Spreading Your Risks.

As a gambler, there is no way to mitigate your loses on a bet or get part of your money back.

Investing provides you with the opportunity to spread your risk across all asset classes, whereas gamblers throw their capital into a single pot with no loss mitigation strategy. Gamblers have fewer ways to mitigate losses than investors do. This is because investors have more sources of relevant information to help their choices than gamblers do.

As a gambler, there is no way to mitigate your loses on a bet or get part of your money back. If you bet N5000 on a lottery and you don’t win, you lose all of your capital. On the other hand, stock market traders can limit their loses by setting stop loss on their trades. A real estate investor can limit loses by increasing rent.

3. Favorability of Odds

“An investment is simply a gamble in which you’ve managed to tilt the odds in your favor.” —Peter Lynch

Overtime, the odds will play out in favour of the investor and against the gambler. Gambling is designed in such a way that the house or owner always has an edge —a mathematical advantage over the player that increases the longer they play. On average and over the long run, there is a negative expected return to gamblers.

On the other hand, investing in the stock market typically carries with it a positive expected return on average over the long run.

Difference Between Investment And Gambling Ppt

4. Knowledge of returns

Investing isn’t gambling. It’s not hoping for a return. Strategic investment means knowing that you’ll make a return. Gamblers hope, but investors know.

“An investment operation is one which upon thorough analysis promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.” —Benjamin Graham

In the world of investing and gambling, information is very valuable. People look look to the past, study historical performance and current behavior to improve their chances of making a winning move. Information like stock and company earnings, management teams, financial ratios, financial statements and profitability can be researched and studied before committing capital.

On the other hand, the information that a typical gambler is exposed to is limited and sometimes insufficient to make a winning decision. Hence, much of gambling is left to emotions and chance.

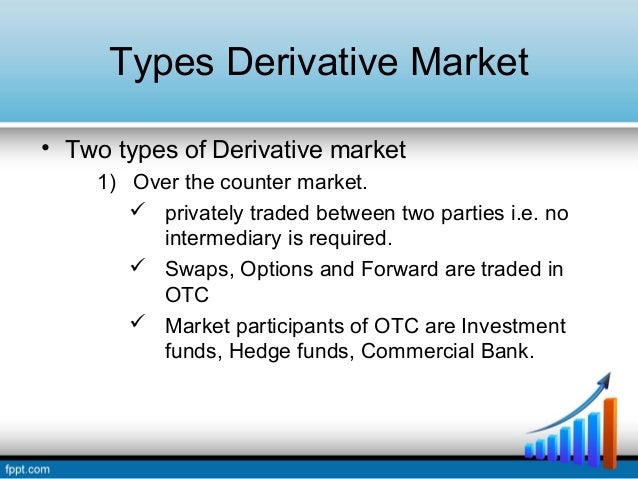

5. Investing is speculation, gambling is chance

Most investing activities involve speculation. Speculation involves calculating risk and conducting research before entering a financial transaction. A speculator buys or sells assets in hopes of having a bigger potential gain than the amount he risks. It is the act of conducting a financial transaction that has a substantial risk of losing value but also holds the expectation of a significant gain, with a positive expected return.

Gambling on the other hand, involves placing bets on high-risk situations that entail a negative expected return. When gambling, the probability of losing a wagered capital is usually higher than the probability of winning more than the capital wagered.

6. Gambling can be addictive and destructive, but investing can’t

Compulsive gambling has been correctly identified as a problem, and organizations like Gamblers Anonymous are helping people cope with the problem. There is no similar problem in investing.

Chris Anderson, executive director of the Illinois Council on Problem and Compulsive Gambling, has said that compulsive gambling isn’t really about making money, it’s about “action”, and the lure of the big win. According to neuroscientist, some chemical changes occur in the brains of compulsive gamblers, since they’re riding on the emotional roller coaster of wins and losses.

This explains the long lines you see at Bet9ja, Nairabet and other football betting shops around the country. Majority of these players lose and still find enough reasons to come back.

Difference Between Investment And Gambling Pdf

Which should you choose?

Difference Between Investment And Gambling Slideshare

Though both have a few similarities, they are uniquely different concepts when it comes to long term wealth creation.

From our discussions so far, which vehicle of wealth creation would you settle for? Investing or gambling?

Difference Between Investment And Gambling

Whatever your choice is, it should align with your investment objective, risk tolerance, and time horizon (short term or long term). You should however be aware that in some jurisdictions gambling may be illegal. Where it is legal, you should be careful to wager only the amount of money you can afford to lose.

In conclusion, gambling should never be confused with investing. Though both have a few similarities, they are uniquely different concepts when it comes to long term wealth creation. Understanding them as separate activities in your mind and implementing same in your portfolio will help you become more successful at managing your money and growing your wealth.

Difference Between Speculation Gambling And Investment

Have you ever met someone who is addicted to gambling or have you been into it yourself? Take a few minutes to narrate your experience in the comments section below. If you have any questions feel free to ask.